According to studies, 36% of all transactions fail due to unmet buyer and seller expectations.

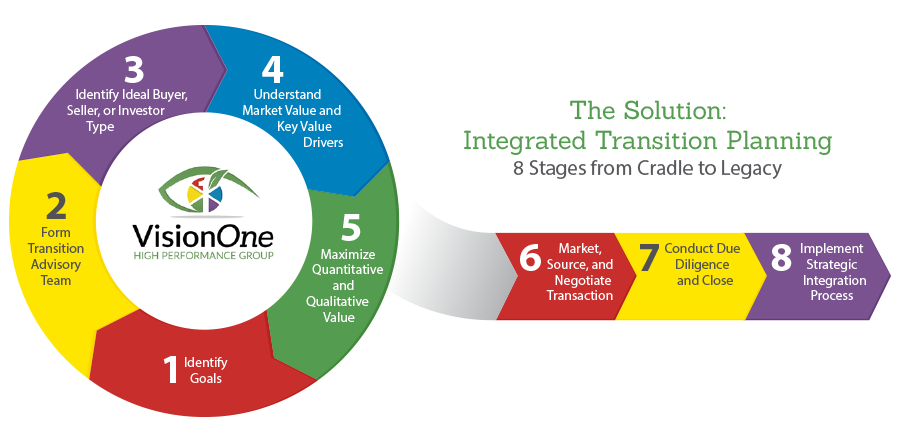

The inability to prove adequate value, and the inability to manage the emotional process that comes with buying, selling and transitioning to the next generation of leadership. VisionOne helps businesses to improve their odds through a time-tested approach that aligns value growth, integration and transition planning to the transaction process, as well as bringing creative sale and financing ideas to the table that other brokers don’t.

Who is this for?

Private, mid-market companies ready to sell, acquire add-on companies, or transition to the next generation of leadership.

Where are you today?

-

Are you a business owner that is considering selling?

-

Are you a family owned business that would like to transition to the next generation?

-

Are you a high growth company that wants to position yourself for the right buyer or investor?

-

Do you need additional capital, expertise, or leadership to help take your company to the next level?

-

Are you looking to grow your company by acquiring a company that can add value?

-

Are you looking to merge with another company in order to take advantage of key synergies that drive value?

We can help.

Case Study: M&A

Preparing for a company’s sale while protecting their employees and community

VisionOne was brought in by an investment banker to help identify key value drivers of a business they were attempting to sell. The industry was becoming commoditized and the business needed to be able to show added value in order to meet the business owner’s transition goals. Time was of the essence, as the business owner needed to sell and could not wait to add value over time. Finally, the business was in a rural community and the business owner wanted to make sure that his employees and community would be sustained.

The VisionOne Solution:

- Assessed the four key driving forces: personal, market, business, and external to understand the best time to sell,

buyer/investor to attract, and position value within the organization. - Leveraged the Value Opportunity Profile® to measure overall value, identify key value drivers, and develop

a roadmap for driving future value with various buyer and investor types. - Assessed key leaders to be able to determine their aptitude and ability to drive future value.

- “Staged” the company to attract buyer/investor that would be the best for the business.

Results

Because of the differentiated value that was uncovered, there were multiple owners and the company was able to sell at a multiple that was much higher than originally expected. The company was able to attract a Private Equity investor that saw their potential, and provided the needed capital and leadership expertise to get the company to the next level. Finally, the investment strategy supported the owner’s long-term goals for his employees and community.

“VisionOne brought creative and sophisticated solutions that I hadn’t thought of. They educated me and introduced me to unique buyers and investors that

I would not have found on my own.”

– Rural Manufacturing CEO

Call us today for a no cost 30 minute consultation.

952-921-5886